For your nonprofit to further its mission and make a positive impact on its community, it’s critical to develop effective community engagement and revenue generation strategies that empower you to cultivate strong relationships with current and new donors. One of the most effective ways to improve your fundraising efforts and achieve these goals is to conduct thorough prospect research.

If you’re brand-new to prospect research or need a refresher on the process, you’ve come to the right place! This crash course will provide a comprehensive overview of prospect research and explain the steps your nonprofit should take to get started.

Screen prospects quickly to get the freshest insights possible. Explore the tools DonorSearch has to help you get ahead!

Especially if you’re conducting prospect research for the first time at a smaller or newer organization, you likely have questions about the process. Let’s begin by answering some of the most frequently asked questions that arise when jumping into donor prospecting.

Prospect research is a technique used by nonprofit fundraisers, major gift officers, and development teams to identify high-impact donors within and beyond an organization’s current donor pool. Through this process, nonprofits gather an immense amount of data—information about donors’ backgrounds, past giving histories, wealth indicators, philanthropic motivations, and more details that help determine prospects’ likelihood of giving.

(Note that prospect research may also be referred to as donor prospecting, screening, or donor research.)

When learning about prospect research, you may come across the term “wealth screening.”

Traditional wealth screening falls under the “prospect research” umbrella. It typically focuses on analyzing current and prospective donors’ wealth markers, such as real estate ownership, business affiliations, and stock holdings. These help your organization determine a donor’s financial giving capacity.

However, just because a donor has the capacity to make a significant gift to your organization doesn’t necessarily mean they’d be willing to do so. Prospect research that takes into account a donor’s philanthropic tendencies and affinity for your mission provides a fuller picture of potential donors than wealth details alone.

Besides conflating prospect research and wealth screening, one of the most common misconceptions around prospect research is that nonprofits use it just to identify new donors when planning a campaign or initiative. In reality, prospect research should be an ongoing process, used not only for new donor identification but also for:

Additionally, while prospect research lays the foundation for donor engagement, it doesn’t take the place of human-centered relationship-building. Use the information you gather through screening to outline tailored outreach and cultivation strategies, then get to know each prospect personally so you can create an individualized engagement plan and make a fundraising ask they’ll be receptive to.

Many different organizations can benefit from incorporating prospect research into their fundraising efforts, including:

Prospect research is most useful for finding potential donors who could contribute significant gifts, since converting them requires more tailored efforts than lower-level supporters. These include supporters who give:

Prospect research can enrich your nonprofit’s operations in a myriad of ways, allowing you to:

Screen prospects quickly to get the freshest insights possible. Explore the tools DonorSearch has to help you get ahead!

To successfully conduct prospect research for your nonprofit, you’ll need a solid understanding of its key elements—the screening tools you’ll use and the indicators you’ll look for in the data you gather. Let’s explore each of these elements.

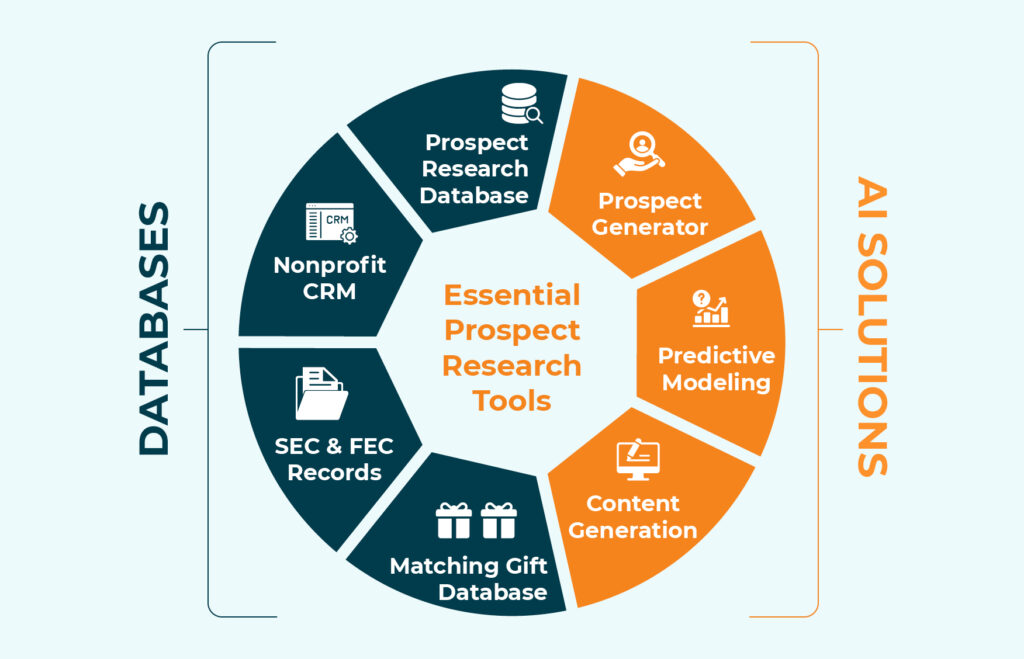

Like most contemporary fundraising processes, successful prospect research starts with the right software. Ensure your organization has the following solutions in its tech stack before you begin:

In addition to these tools, simple internet searches and deep dives into prospects’ social media profiles (such as LinkedIn, Facebook, and Instagram) can help reveal who your donors are and what they value.

Discover how DonorSearch’s wealth and philanthropic screening tools, PVO2, DonorSearch Ai, Enhanced CORE, and our partnership with Momentum can help your nonprofit learn about potential donors in detail!

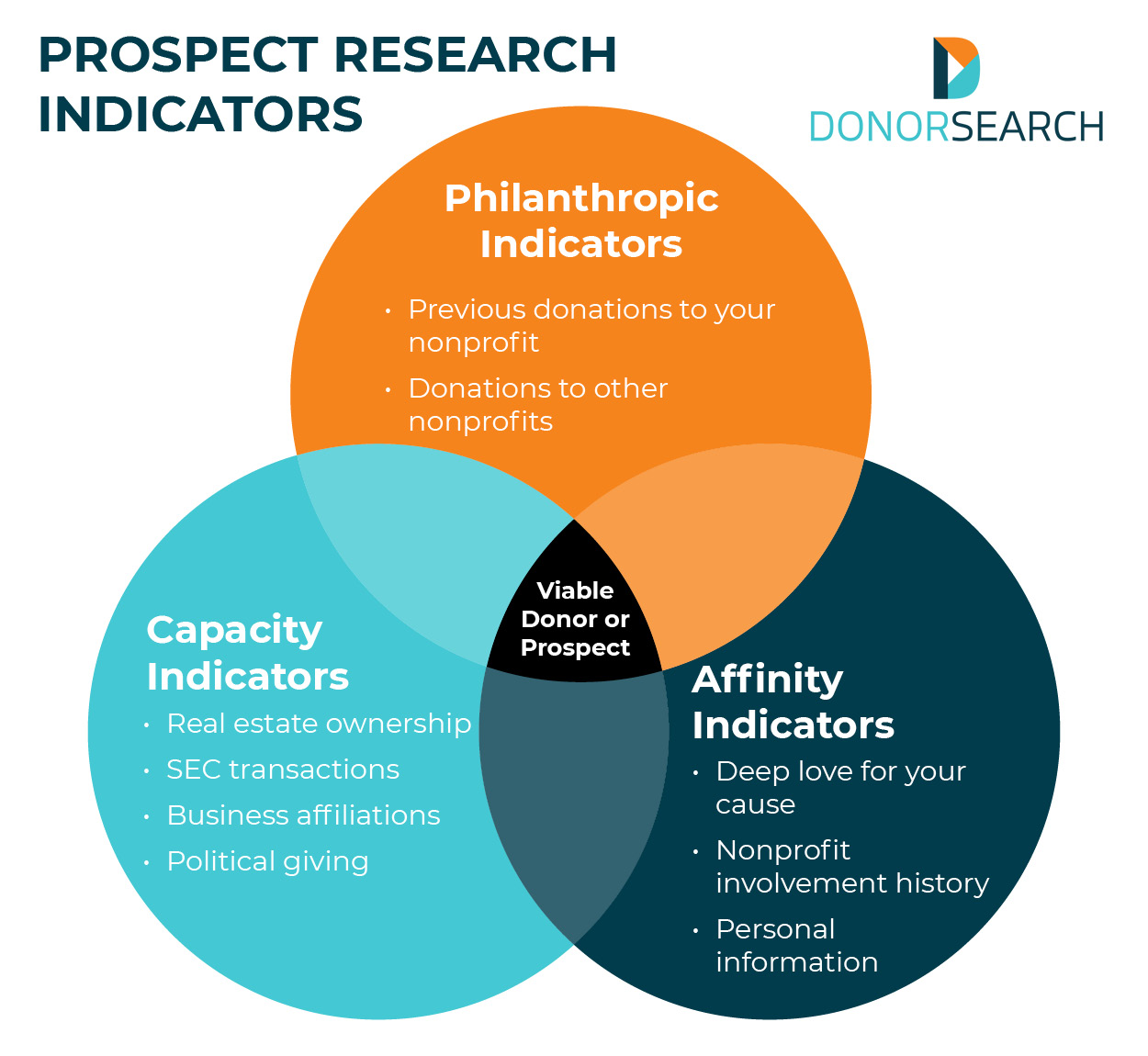

During the prospect research process, you’ll be looking for three kinds of indicators (or markers) for each potential donor: capacity (wealth) indicators, philanthropic indicators, and affinity (warmth) indicators. Let’s dig into each category in more detail.

These indicators help you to know whether or not a donor or prospect is in a financial position to give a large gift, and can assist you when determining how much to ask for down the line. Here are a few examples of wealth indicators:

These indicators show that a donor or prospect may be willing to contribute to your organization because they have philanthropic tendencies. The two main philanthropic markers are:

These markers indicate that a donor or prospect may be willing to give to your organization because they’re passionate about your specific work. Some examples include:

Remember that in thorough prospect research, you can only say you’ve found a viable prospect if they exhibit all three types of indicators. The greater these markers are in quantity and quality, the higher priority the prospect should be on your outreach list.

You have a few different options when it comes to how you conduct prospect research. Let’s look at each approach and why your organization might choose it.

If your nonprofit is just starting out or if you have a tight budget, you may have an existing staff member (usually someone from your development team) take responsibility for prospecting. Although this likely won’t be a sustainable long-term solution as your organization grows, it’s an accessible way to begin prospect research so you can kickstart your nonprofit’s growth. To assist with this DIY approach, there are plenty of great resources (guides, classes, webinars, etc.) available through popular prospect research channels.

The other way to conduct prospecting in-house is to hand the job over to full-time research staff. Building a research team will likely be helpful if you have a large prospect pool and need to free up other staff members’ time.

Start by hiring one employee to lead your research efforts, then expand the team as your nonprofit’s needs grow. Look for candidates who have strong analysis skills, experience in fundraising and working with databases, and the ability to synthesize data.

Another option for conducting prospect research (especially if you don’t want to eat up your staff’s limited time and energy) is to hire a prospect research consultant. If you’re interested in working with one of these experts, ask yourself the following questions:

Consultants can assist you at every stage of the prospecting process, from screening donor records to putting your data into action and beginning to cultivate relationships with prospects.

A prospect screening company (like DonorSearch!) can be a valuable partner, especially if you want to find major donors in your current supporter base. These experts can help you know who among your donors would be an ideal major giving candidate and how much would be feasible to ask for from them.

If you have a large number of records in your donor database, a bulk screening could help you sort through the masses of information. Bulk screenings sift out only the most pertinent and useful donor data and format it so it’s easy for your organization to analyze.

A screening company can help your organization as it grows, too. If you’re acquiring new supporters regularly, screening services can help you keep track of, sort, and assess the new prospects you’ll likely gain.

Look for a company that will seamlessly integrate its tools with your existing software and align with your normal workflow, meaning that your data will always be easy to get to when you need to access it. Many screening companies offer comprehensive integration support to make the data transition as smooth as possible.